It may take some bit of work until you get the idea of how to improve your credit score. A credit score may be one of the most important aspects of your financial situation that would need your constant monitoring, especially if you always have the need to borrow money from lenders. Having a low credit score will ensure you of having trouble getting your credit application approved as you would have wanted.

It may take some bit of work until you get the idea of how to improve your credit score. A credit score may be one of the most important aspects of your financial situation that would need your constant monitoring, especially if you always have the need to borrow money from lenders. Having a low credit score will ensure you of having trouble getting your credit application approved as you would have wanted.

Your credit score tells lenders of how dependable you are as a borrower. From your credit score, lenders and credit institutions may be able to gauge your standing as a borrower. That is because the credit score is a mathematical measure of a person’s borrowing habits and behavior based on some important credit factors. A formula developed by the Fair Isaac Corporation (FICO) is usually used to calculate for one’s credit score. That is why your credit score is also usually referred to as the FICO score.

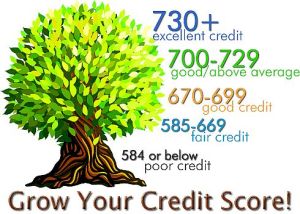

When you have a low credit score, it tells the lender straight away that you are not a very prospect as a borrower. This may be based on your previous credit accounts from which you may have defaulted on, late payments of debts, bankruptcy or foreclosure issues that you may have in the past and other similar factors. The higher your credit score, the more attractive you are as a borrower in the eyes of the lenders. This might mean that your credit application from them might just be easier to approve.

There are many ways that you may be able to improve on your credit score. This will include having a closer look at your current credit standing. If you do have outstanding credit to take care of, it would be good to pay your bills on time. Delinquent payments of your outstanding credit have a major negative impact on your credit score. It is also important to note that the longer that you try to pay your bills on time, the better it will be for your credit score.

If you do find yourself missing on some payments, it may be wise to get current as quickly as possible on your payments if you so can. Staying current with your outstanding credit accounts may also have an effect on your credit score. What’s more, your credit record, along with the missed or delinquent payments, may reflect on your credit report and will stay there for a period of seven years. It will be looked upon as a smudge on your report even after you have paid off your debt.

If you find yourself having a hard time managing your outstanding credit, it may be time that you contact your creditors or ask for the help of a qualified credit counselor. These actions may not immediately improve your own credit score. But the sooner you act in managing your debts well and paying your bills on time. It will eventually make your credit score better over time.

Once you learn how to improve your credit score, the better your chances will be on availing of a much needed loan or mortgage when you really need it. It would be frustrating for one to apply for some much needed credit and not get approved in the end, all because of a low credit score.

Improving your credit score can also assure you that you have better credit options especially during times that you might need it most.

Your credit score is one of the most important numbers you’ll carry through life — like it or not.

Your credit score is one of the most important numbers you’ll carry through life — like it or not.